After procrastinating for months, I’m finally getting around to sharing what so many people have requested. Before I begin this post, I just wanted to say that I’m not an expert at all. I probably won’t share anything that you haven’t heard before. And there are definitely many ways that we could be better at saving money. But one of the questions I hear the most often is how we’re able to afford a large family. So I wanted to share a bit of our backstory, where we are now, and some ways we’ve been able to save money. This is more of a “how we’re able to do it” post instead of an advice post. But hopefully you’re able to get some ideas from it!

So let’s back it up to 2007. Shortly after we got married, Don got a job as a barista at Starbucks making minimum wage with only about 30 hours a week. The amount of money he brought home every month barely covered our living expenses. And yet, we always had money in our savings and never lived paycheck to paycheck. God truly provided for us. When we got our tax return money, we would put it in savings and if we had extra expenses, it came out of there. We also had wonderful landlords (who are our dear friends) who let us rent our 3 bedroom home at a very great price.

I remember very clearly one night when we went over to our landlord/friends’ house to create a budget. With a little bit of Dave Ramsey’s methods, our friend helped us put together our budget. It took a long time to be able to figure out how to stretch our money to go into each category. After we finally got it figured out, I cried. I couldn’t believe how little money we had. We were truly struggling.

I’m sharing this backstory with you because those difficult years taught us so much. We learned to be wise with our money. We are both pretty frugal minded people anyway, but this just pushed us to an extreme. Those years taught us how to really think through our purchases and decide if they were worth it. We didn’t have the luxury to just buy anything we wanted. So I learned pretty quickly the difference between want and need.

Anyway, fast forward about 2.5 years when Don got a job at Quiktrip (a gas station/convenience store) and he started out making at least 3-4 times what he had been making at Starbucks. After being used to living on such a strict budget, it felt like all of the sudden we had such a huge income. In reality, it probably wasn’t a ton. But it felt like we had so much money. We did re-evaluate our budget a bit to reflect this new income. But after years of having to learn how to survive on a tight budget, we carried over what we learned. We were able to start setting aside money every month in savings. And after 5 years of saving (and searching for a house,) we were able to put down about 40% for a down payment on our house and still had months worth of an emergency fund leftover.

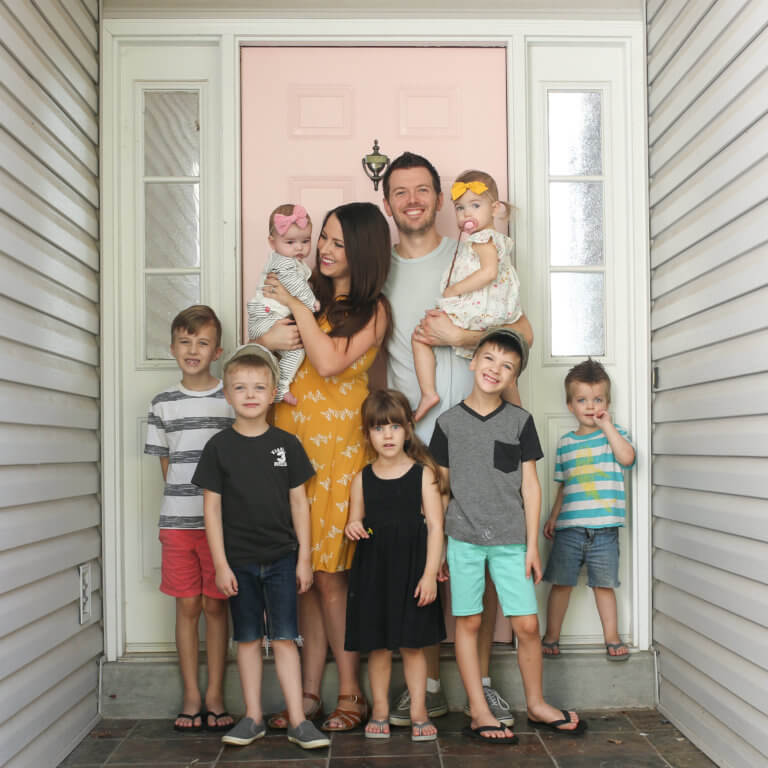

Fast forward another (almost) 8 years and here we are with 7 kids and not much of a guaranteed income at all. Don worked at Quiktrip all those years while I stayed home with the kids. We have always only lived off of one income. (You can read a bit about how Don recently quit his full time job to transition to working from home in this post.) A lot of people assume you have to make loads of money to support a big family and that simply is not true.

Now I will say that I am speaking as someone who lives in the midwest, where the cost of living is pretty decent. The cost of buying a shack in California would buy you a mansion in Missouri. But also keep in mind that the income is also lower. I’m sure it still doesn’t compare but it’s a good thing to keep in mind.

So how are we able to do it? Well here are some of the many things that have helped us over the years. I’m just going to list as many things as I can and then explain each one.

- Writing out a budget and sticking to it. This is something we were really good about for the first half of our marriage. And then it got harder to keep up with. We kind of go back and forth with being strict about it. But it definitely helped us learn how to be wise with our money. So it’s something we’re constantly trying to get back to doing. It’s always good to see where your money is going so you know where you need to cut back or where you have a little more money to spend.

- No debt. Besides our home mortgage, we have never had any sort of debt. We are very fortunate in this department. I know how much of a setback that can be for many couples so I’m thankful that neither of us had any debt when we got married. And we will do our best to help our children avoid massive debt as they get older.

- No car loans. I know not everyone has the same mindset with vehicles. But to us, we would rather pay for an older vehicle in cash than to take out a loan for a newer, fancier vehicle. All our vehicles have been no more than $6500 and they have served us well, with no major issues.

- Buying secondhand. I would say that a good portion of our belongings were purchased secondhand (or aquired from someone gifting/giving away something.) Most of our clothes are thrift store/garage sale purchases or hand me downs. I try to visit the thrift stores around us pretty frequently…even if it’s just a quick 10 minute scan to see what’s new.

- Shopping clearance/sales. This one is probably a no-brainer. But when I do purchase new things, I make sure to wait for a sale. A lot of our new clothes come from Old Navy or Target and I don’t think I ever buy anything if it’s full price. The clearance racks are always my first stop. Coupons are also great! I use apps for coupons/discounts (like the Cartwheel app from Target) but besides that, I’m not much of a couponer.

- Shop at Aldi. I know not everyone has one near them. But for us, this has helped us save so much money over the years. I can do pretty much all of our grocery shopping there, minus the 2-3 items that they don’t carry. We love their food! I used to be kind of picky with certain items, preferring the name brand instead. But now I don’t care as much. And I actually prefer the Aldi brand over name brand a lot of times. I also do some bulk shopping at Sam’s. I’ll be doing a more detailed post about groceries/meals for our family soon!

- DIY. For as many things as possible, we try to find ways to do things ourselves. I cut everyone’s hair in our family–which saves us a lot of money. We don’t go out to eat often. We don’t hire out maids, or lawn care, or babysitters. As I’m typing this, my dad and husband are hammering away to finish a room/bathroom in our basement–doing the work themselves instead of hiring out. When the boys inevitably rip holes in the knees of their jeans, I cut off the bottoms and turn them into shorts for the summer. I always do homemade birthday desserts instead a store bought cake. We used to make homemade laundry detergent which was sooo much cheaper (I just recently switched to Tide because it’s much better with stains.) Basically if there’s a way to do it “homemade,” we consider those options before anything else. We don’t always go with whatever is cheapest, but it’s always good to see what things could be switched out for a cheaper version.

- Free activities. St. Louis is a great place to live for free events/activities. The Zoo, Science Center, multiple splash pads, parks and playgrounds. The majority of things we do are free. Or if it does cost money, we wait until there is an opportunity for a discounted admission.

- No cable/movies. We don’t buy any of the extra luxuries. Sometimes it’s a bummer to have to miss out a show. But in the end, it’s one of the things that we decided just isn’t worth it for our family. We also don’t really buy cds, dvds, etc. For the most part, we either borrow or rent. Did you know the library actually has a decent selection in their media section? We usually have to wait a little bit after a movie is released to see it. But to us, it’s worth it to save a little money.

- Credit cards. We use a credit card as much as we can–which I’m sure is against a lot of financial advice you’ve received. The difference is that we use it as more of a debit card, only spending what we can afford. We use it for gas, groceries, etc. instead of our debit card. And at the end of the month, we pay it off in full. If we don’t have the money for something, we simply do not purchase it. But this allows us to build our credit and get cash rewards for things we are already buying.

I’m sure that’s not everything but right now that’s what I can think of. I actually have been procrastinating finishing this post–it’s been 75% finished for weeks. But I’ve been so afraid that I’m going to leave something out so I kept putting it off. I decided to finish it and see if anyone else had any other money saving tips to add!

Like I said, this isn’t a “this is what you need to do to save money” type of post. It’s just sharing how we’ve been able to make it work. I’m hoping that it helps you see that you don’t have to be making loads of money to be happy or have a large family. Right now, we are living off of Don’s part time job, my occasional sponsored instagram posts (I only partner with brands who I believe in and are the perfect fit, so I haven’t been accepting many lately,) and our “business startup” fund. So we’re just doing our best to be wise with our money. I know we don’t always make the wisest choices. And I know there are probably a lot of other families who manage their money far better than we do! So that’s why I didn’t intend this post isn’t really an advice post. (I just wanted to make that extra clear haha.) I would love to hear some of your ways you save money!

Thanks for being patient with me as I’ve been struggling with the lack of motivation to work on my blog lately! I hope you’re having a great week!!